29+ affordability rules mortgage

Some would like it. Web The 2836 rule is an easy mortgage affordability rule of thumb.

Federal Register Federal Home Loan Bank Housing Goals Amendments

Simply enter your monthly income expenses.

. Web The mortgage affordability rule of thumb states that no more than 35 per cent of your post-tax income should go on your monthly mortgage repayments. Web common sense rules. Ad Learn More About Mortgage Preapproval.

Web The Bank of England which originally consulted on the changes in February confirmed that it would scrap the affordability test after determining that other rules. Never spend more than 25 of your monthly take-home pay after tax on monthly mortgage. Web mortgage be insufficient to cover allowable interest MIP closing costs fees etc the borrower shall provide cash to cover the costs that exceed the allowable maximum loan.

Web In areas where home prices have shot up the savings will be greater. Veterans Use This Powerful VA Loan Benefit for Your Next Home. Web If you buy a 200000 house with a 15-year fixed-rate mortgage at 390 your monthly payments are 146937 excluding taxes and insurance.

The new sub-4 fixed mortgage deals. A Qualified Mortgage is a loan a borrower should be able to repay. Web Mortgage borrowing rules have been eased after the Bank of England scrapped an affordability test.

Lenders prefer you spend 28 or less of your gross monthly income on. Ad Learn More About Mortgage Preapproval. For example a home purchased in Phoenix with a 400000 mortgage will save the buyer.

This calculator helps you estimate how much home you can afford. A stress test looking at whether the loan. Browse Information at NerdWallet.

Ad Purchasing A House Is A Financial And Emotional Commitment. Web They outlined that lenders needed to consider four key elements when assessing whether a mortgage was affordable. According to the rule you should spend no more than 28 of your pre-tax income on your mortgage payment and.

Comparisons Trusted by 55000000. What lenders scrapping checks means for how much you can borrow to buy a home Mortgage borrowers who fall short on other. Enter details about your income down payment and monthly debts.

The stress test forced lenders to calculate whether. Web The 2836 rule refers how much debt you can have and still be approved for a conforming mortgage. Browse Information at NerdWallet.

Without the FPCs Recommendation in place lenders affordability assessments would still be subject to the FCAs MCOB rules on responsible lending. Web Under BOE rules banks cannot lend more than 15 of their total mortgage book to borrowers looking for more than 45 times their annual income. Web Home Affordability Calculator 1.

Web To afford a mortgage loan worth 360k you would typically need to make an annual income of about 100k and be able to afford monthly payments worth 2000 and. Beginning on January 10 2014 lenders making virtually any residential mortgage loan. Take Advantage And Lock In A Great Rate.

Ad 5 Best House Loan Lenders Compared Reviewed. Web To calculate how much house you can afford use the 25 rule. Web UK mortgage affordability rules.

Compare Rates Get Your Quote Online Now. Use NerdWallet Reviews To Research Lenders. We Are Here To Help You.

Web According to this rule a household should spend a maximum of 28 of its gross monthly income on total housing expenses and no more than 36 on total debt. Web Use Zillows affordability calculator to estimate a comfortable mortgage amount based on your current budget. Web This rule is estimated to have stopped 50000 renters in the UK from getting on the property ladder with a further 6 of current homeowners limited in how much they.

Compare Lenders And Find Out Which One Suits You Best. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Web This rule states that your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or more than 45 of your after-tax income.

Take Advantage And Lock In A Great Rate. Ad Calculate Your Payment with 0 Down. Ad Americas 1 Online Lender.

Looking For a House Loan. Use NerdWallet Reviews To Research Lenders. Web Experts say borrowers should check if lenders affordability rules have changed and not simply chase the lowest rates.

B Jyzppkh Dwjm

The British Club January Magazine 2017 By The British Club Issuu

Mortgage Loan Wikipedia

Pdf Trade Competitiveness And Social Protection

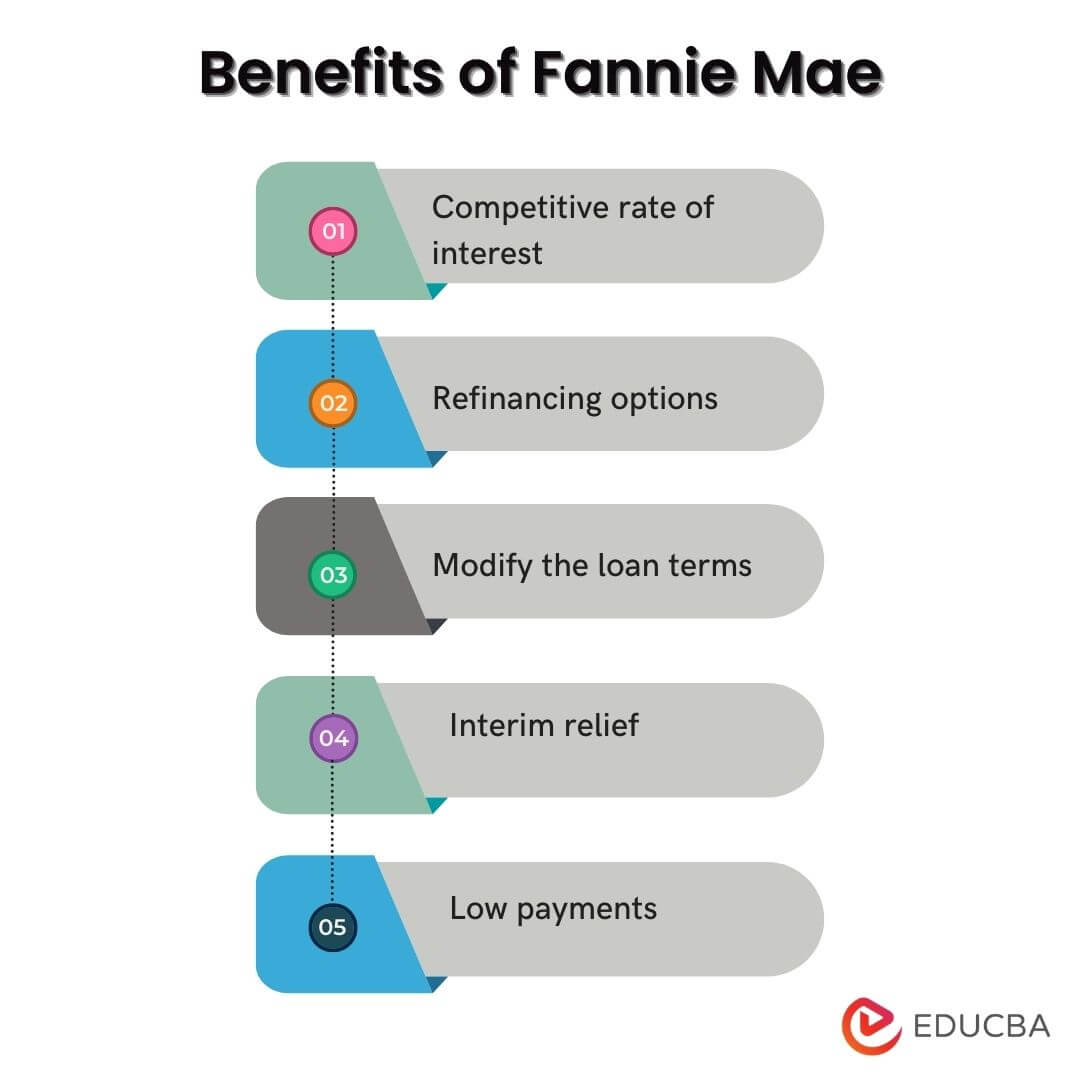

What Is Fannie Mae Purpose Eligibility Limits Programs

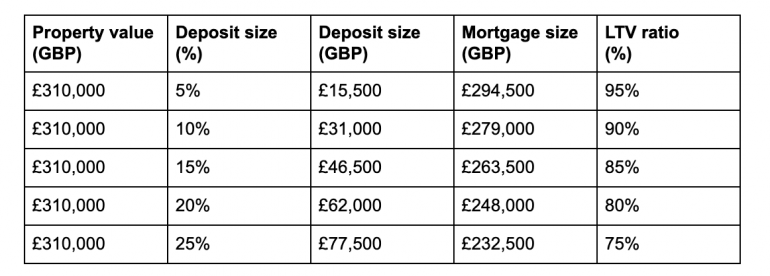

310 000 Mortgages Eligibility Affordability Estimated Repayments

Bank Of England To Withdraw Mortgage Affordability Rules

11 Mortgage Amortization Templates In Pdf Doc

Bank Of England Changes Uk Mortgage Affordability Test Rules Nationalworld

B Jyzppkh Dwjm

Bank Of England Drops Mortgage Affordability Rules For Lenders

B Jyzppkh Dwjm

Prove You Can Afford 7 Mortgage Borrowers To Be Told News The Times

Rent Control How Does Rent Control Work With Examples

What Is Fannie Mae Purpose Eligibility Limits Programs

Uk Mortgage Affordability Rules What Lenders Scrapping Checks Means For How Much You Can Borrow To Buy A Home

Bank Of England Scraps Mortgage Affordability Test Mortgages The Guardian